MMT & FTPL: Together at last?

Some have speculated (or asserted #KeynesPizzaDinner) about a connection between Modern Monetary Theory (MMT) and the Fiscal Theory of the Price Level (FTPL), as both describe a world where monetary policy is irrelevant.

A central idea in MMT is that government spending should not be constrained by concerns about debt as long as spending can be financed by money creation. There is a connection between MMT and a fiscal theory, but we'll need to start from the basics to see it. The basics are flow budget constraints for fiscal and monetary policy makers. (What follows is a narrative version of the account in Sections 7.1-7.2, which has the equations, which is indebted to Sargent and Ljungqvist, [78] in the textbook.)

For the fiscal budget, any deficit is funded by bond issue and a transfer from the central bank. The central bank issues money to pay for bond purchases and the transfer. The usual monetary policy story is that the central bank controls the money supply by purchasing or selling bonds, but that's not our focus here. (BTW, its not even Fed practice today.)

The transfer is the difference between the deficit and the bond issue, and its also the difference between the change in the money supply and the bond purchases (by the central bank). Equating these two versions of the transfer (the equations really help here) give a government wide flow budget constraint.

deficit = new bonds held by the public + change in the money supply

The new bonds held by the public are those issued by the fiscal authority but not purchased by the monetary authority.

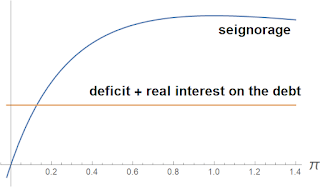

Some more math gives birth to the following steady state relationship (π is inflation).

real deficit + interest on the real net debt = seigniorage(π)

As a graph, the government budget situation looks like this:

You have to take on faith that higher inflation (usually) means higher seigniorage, but that's not a stretch for most folks. Higher deficits mean higher inflation in the long run.

The MMT prescription has the advantage that it gets rid of the interest on the debt. How?

One way to do the MMT thing would be to require that the central bank purchase all the bonds issued then hold a public bond burning so everyone knows they will never enter the market. Hence, the number of new bonds held by the public is zero, and the deficit is funded by new money and nothing else. The government constraint is now

real deficit = seigniorage(π) ,

On the graph under MMT with no interest on the debt, either the line shifts down meaning less inflation, or the the government can run higher deficits at the same level of inflation.

|

| MMT policy |

MMT is a special case of the model showing the unpleasant monetarist arithmetic of Sargent and Wallace (1981, [12]), sometimes called the fiscal theory of inflation (FTI), which only sounds like the FTPL. The unpleasantness appears on the graph when the central bank sells bonds, which is the usual prescription for fighting inflation, and the result is higher debt and interest payments, which raises inflation (Doh!). This is not so counterintuitive if you remember these are all steady state equations, so the bond sale is permanent, unlike the usual open market operations where the central bank changes its mind about buying and selling on a regular basis.

The MMT policy takes the unpleasantness and makes it pleasant. If selling bonds is bad, let's buy them all and never pay interest again.

Is it really that easy? Not really. If the central bank has to buy all the bonds issued, it has no ability to act as a stabilizing force on inflation or recessions or anything else. Active monetary policy could be done with interest on reserves, but then the cost of interest on bonds get shifted over to interest paid to banks, removing the biggest benefit of MMT.

Also, all these equations above are steady state relationships, meaning very, very, very long run outcomes, which raises the question how do we get to a situation where there is no debt held by the public. If Jerome Powell told his people to go buy all the bonds tomorrow, that would cause inflation.

Also, under MMT policy, the bond market ceases to exist. Might be something to consider.

So there is a real benefit to MMT, and there is a real connection to a standard fiscal-monetary theory, but there are also some big questions to be answered before we head down that road.

.png)

Comments

Post a Comment